If you're like most of us, January began with a commitment to having a stronger hold of your finances. February was good, too. I mean it was only 28 days! Then all of the pretty things caught your eye and - whoops! What budget?

Marketing, spring fever, retail therapy - whatever caused this budget slip, it happens. The great thing is, you can get back on budget TODAY.

Before we get into the steps, I do want to say that l believe a budget should have built-in opportunities for you to have fun. There should be fun money/blow money/allowances for you to enjoy things that you like. Even after going off track.

Okay, so...

1: Start today!

Mistakes happen. Don't beat yourself up about it. Get back on track by recommitting to your budget today. Maybe the mistake was that your budget needed a little tweaking. Did you forget to build in that fun money? Whatever it was, focus on moving forward.

2: Write it out.

If you are not writing out a plan for your budget, stop reading after this step and get to it! This is essential for getting back on track. Write down what you plan to use your income for. Plan for it all of the way down to the last penny. (Zero-based budgeting) Hello - savings! I'm a tried and true fan of The Total Money Makeover. A [written] budget is telling your money where to go, instead of wondering where it went. (Dave Ramsey)

3: Assess What Happened

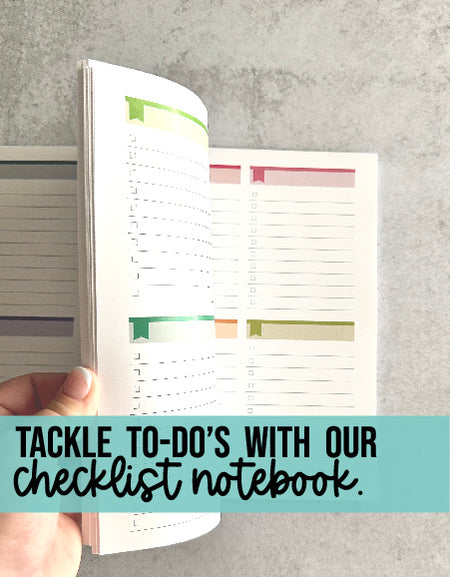

It's easy to get off track with your budget if you cannot see where your money is going. Not only should you write down what you plan to do with your income, you should write out what actually happens. Last month, we were hit with several Dr. visit co-payments when our youngest caught a nasty virus. Fortunately we'd started a sinking fund for medical payments. I wrote all of that out in my budget notebook because it helped us to better understand where our money went and how much we need to adjust our budget for future months.

4: Make Adjustments

As I mentioned before, you should have fun. Budgeting is not a way to eliminate the things that you want. Following a budget should put you in a place of confidence when you're making a purchase. Confident that the money isn't needed for something else, confident that your necessities are taken care of, and confident that the card transaction won't be declined. Each month will be different. Some months you'll need a oil change or a new transit pass. Some months, you won't. It's so important to plan out each and every month. I really like having the budget notebook because I can see when certain annual or semi-annual payments are, right away. Revisiting your budget each week may even be necessary for the first few months. Things shift and you will have to plan for it.

5: Celebrate your success

Going from no budget to a zero-based budget may feel like a big step. I get it. How do you keep on track? You celebrate the baby steps. Stay within budget, of course. Small celebrations don't have to cost money. Let's say you get back on track and have a full two weeks of on-budget-spending. Celebrate! Spend an extra 10 minutes in your bubble bath or watch an extra episode of whatever show you're trying not to completely binge watch. You deserve it! You adulted and adulting is hard.

Let me know in the comments how you're doing on your 2017 budget. Also, check out the budget notebook that I use in the Limelife Planners Shop.

Comments